Question 2

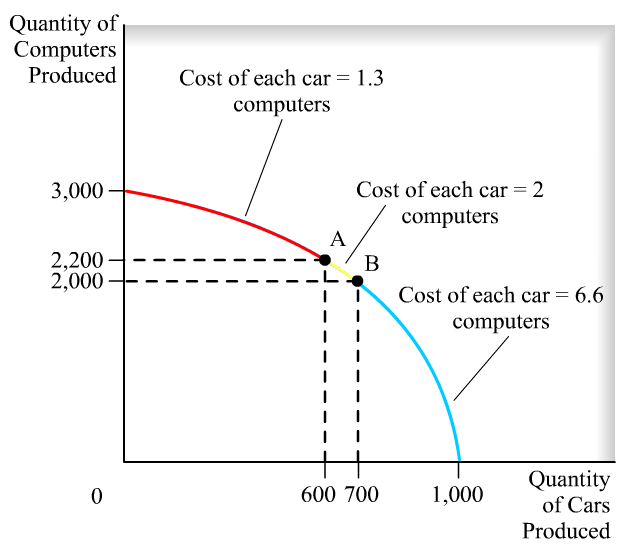

- Concave-to-the-origin production possibilities frontiers are due to the law of increasing costs

Question 8

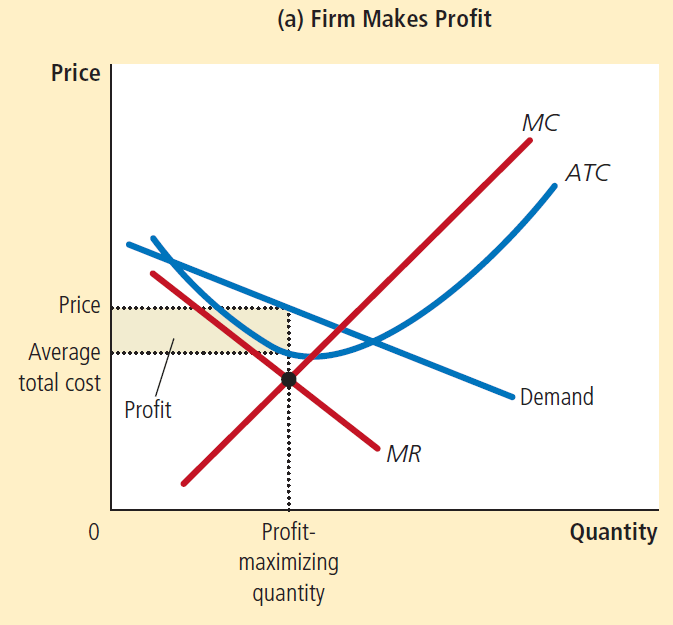

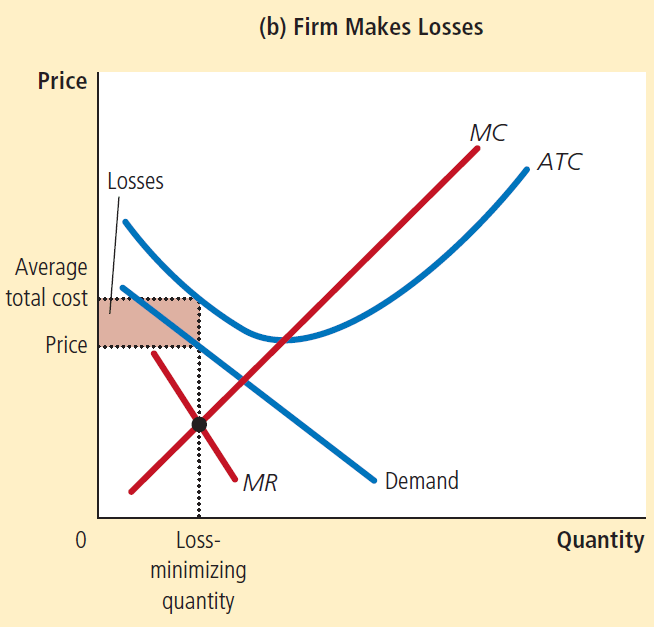

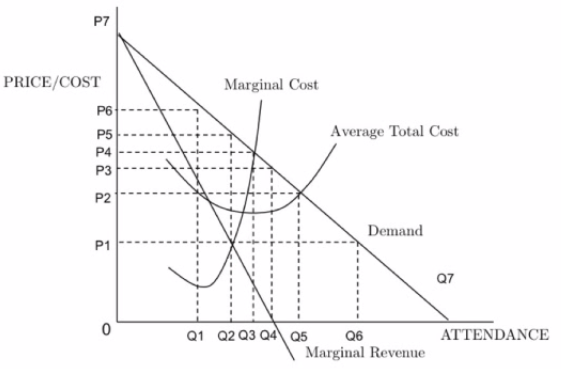

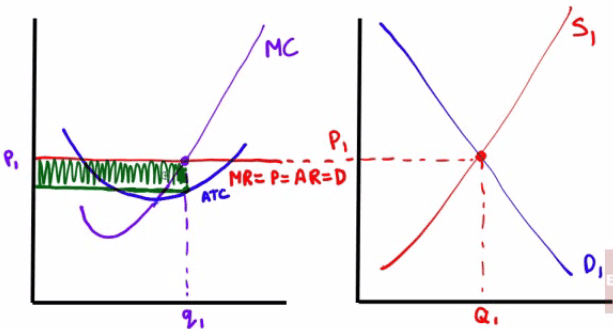

Economic profits = (Demand - ATC) * Quantity

Question 10

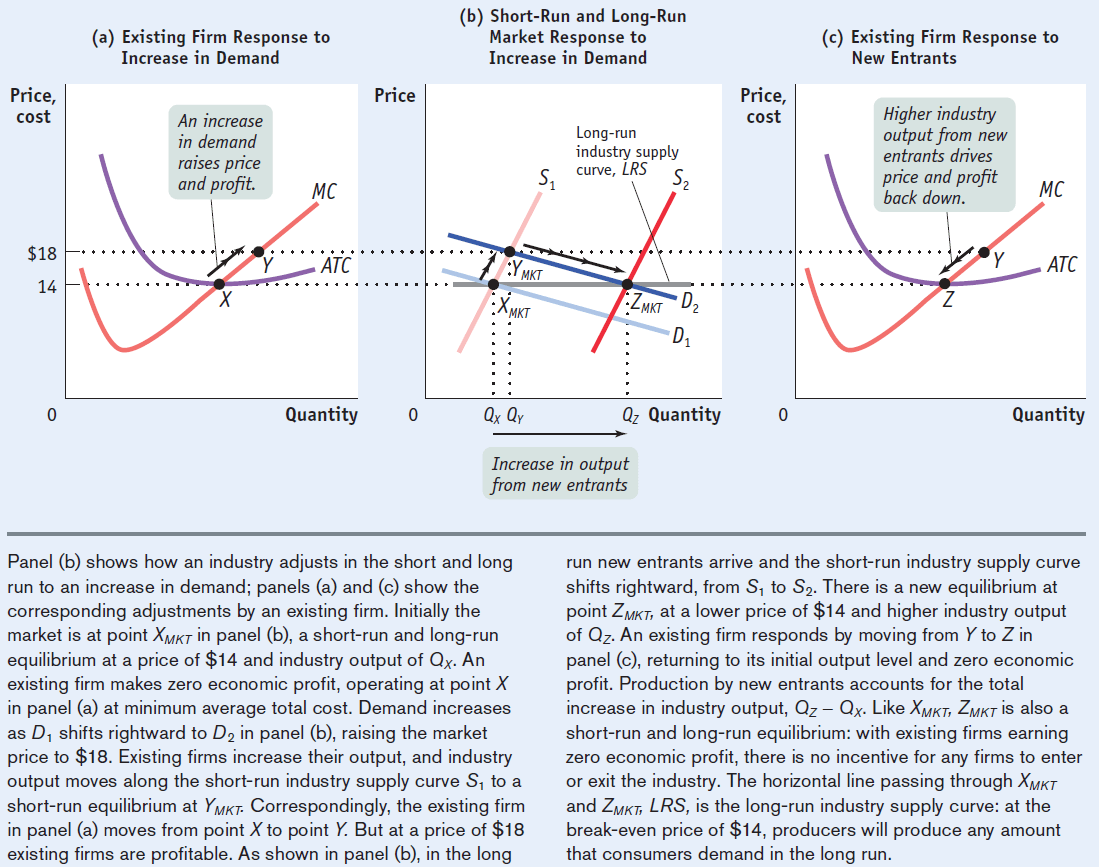

- An increase in demand will cause no change in the long-run equilibrium price for a constant-cost perfectly competitive industry.

Question 21

- With the conditions of a natural monopoly, long-run average total cost decreases as output increases

Question 25

If the average variable cost of producing 5 units of a good is $100 and the average variable cost of producing 6 units is $150, then the marginal cost of increasing output from 5 to 6 units is _____.

6 * 150 - 5 * 100 = 400

Question 28

economic profit

- The difference between the total revenue received by the firm from its sales and the total opportunity costs of all the resources used by the firm.

accounting profit

- The total revenue minus costs, properly chargeable against goods sold.

Question 34

Question 38

MR = P = AR = D is above the ATC curve

Make sure the ATC and MC intersect at the minimum ATC

The market is always right!

Economic Profit shaded in green

P > minimum ATC, Firm profitable.

Entry into industry in the long run.

Question 42

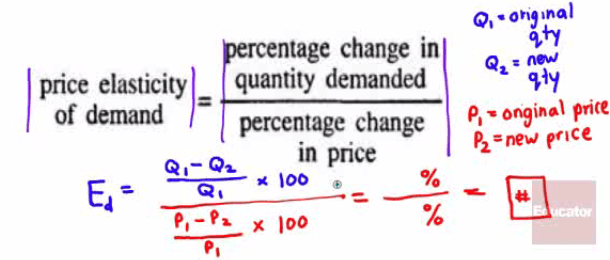

- If the demand for labor is relatively inelastic, an increase in the effective minimum wage will have less of an impact on employment

Question 43

Question 46

The opportunity cost of …

… going to college for a year is not just the tuition, books, and fees, but also the foregone wages

… seeing a movie is not just the price of the ticket, but the value of time you spend in the theater

Question 47

Scarcity exists when the amount of the good or resources offered is less than what users would want if it were given away free.

Free or nonscare goods such as natural resources: oxygen and sun's rays are available in abundance

Question 51

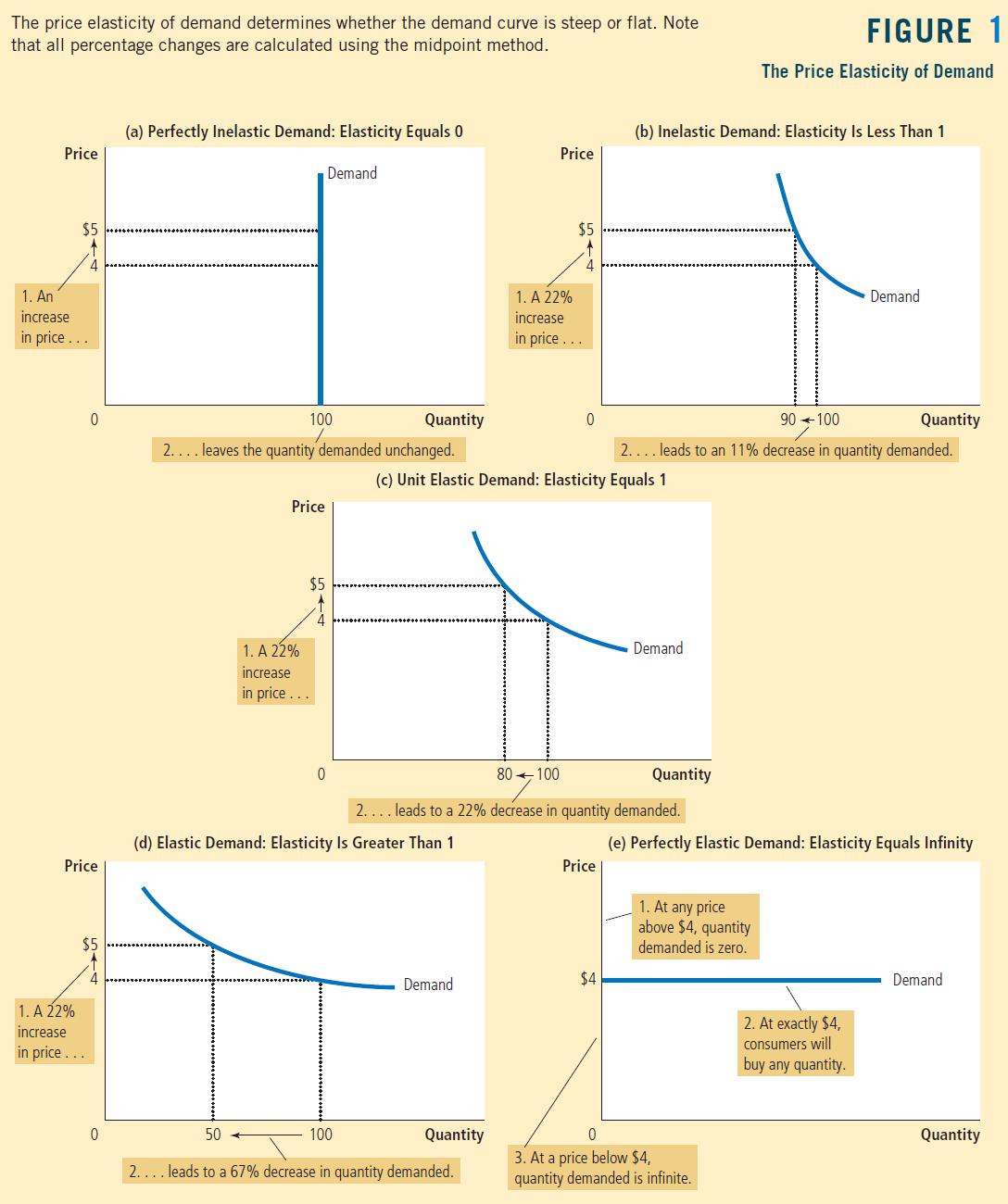

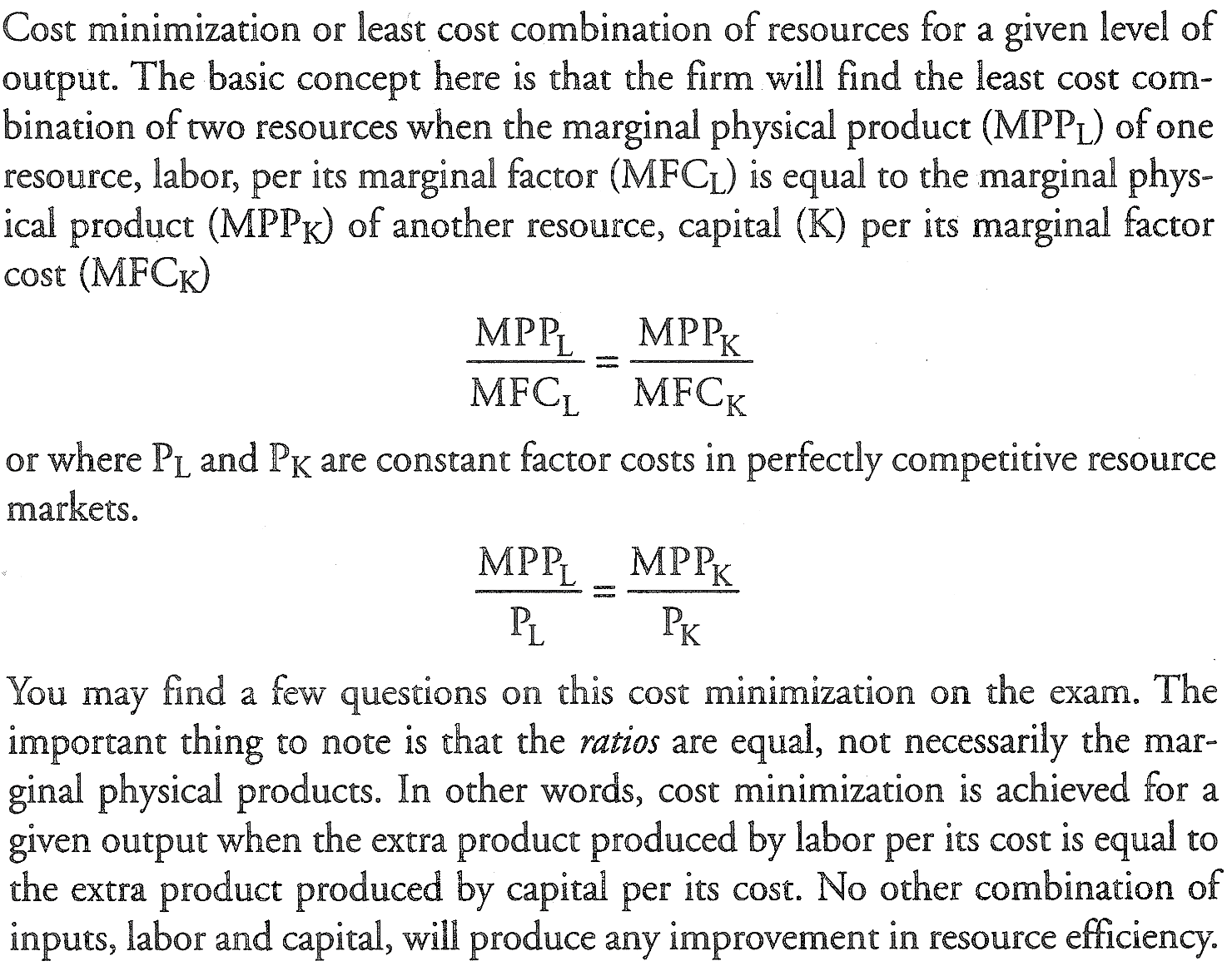

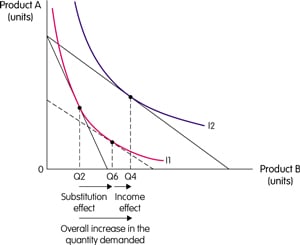

The demand curve for a normal good is downward sloping because the income and substitution effects move the quantity demanded in the same direction.

Income effect:

The money saved can be used for buying another commodities. This can be termed as Additional Income

E.g. when the income increases, individuals buy expensive products instead of inferior products

Substitution effect:

It's an effect which is caused by rise in prices that induces a consumer to buy a relatively lower-priced good and less of a higher-prices one.

This is forced to occur due to fall in income or rise in prices

Question 54

Question 57

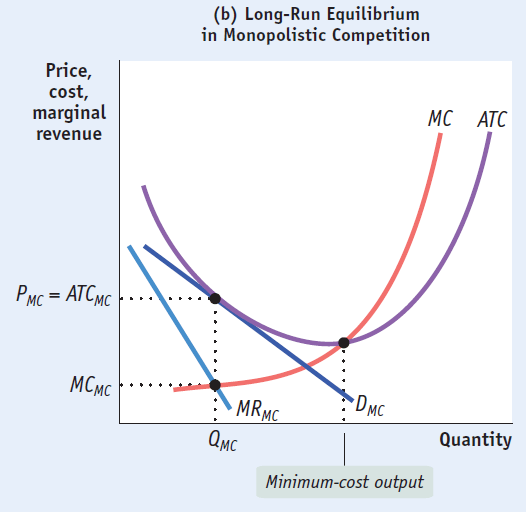

Advertising is frequently used by monopolistic competition to

Increase demand

Reduce demand elasticity